Using a Financial Model

Course Description

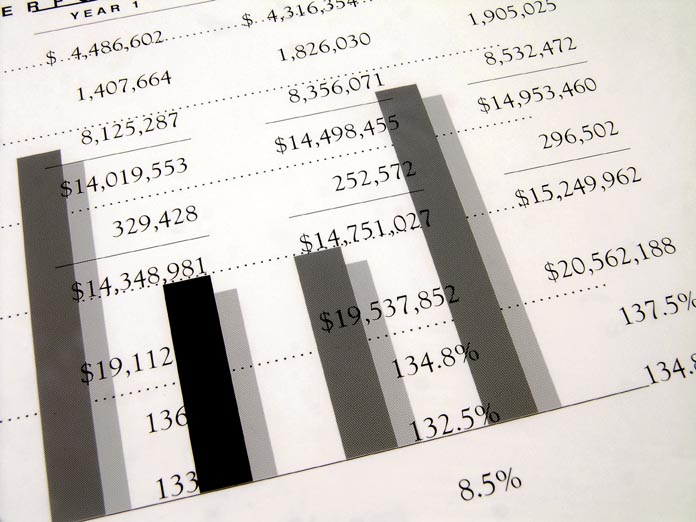

A financial planning model picks up where the cost of service leaves off and projects the financial condition of the utility for a 10 year planning horizon. The information contained in the financial planning model provides a good look at “where we are headed” financially over the next 10 years. This look forward is not wishful thinking but instead is a careful look at what a utility’s financial condition will beif current trends continue. This course will show how to use the following information provided by a good financial planning model to improve utility management processes.

Learning objectives

The output of a financial planning model is typically used by many cooperatives to support applications for loans. However, financial planning models can also be used to explore what a cooperative’s financial situation will be if current trends continue. This course will show how to use financial modeling as an integral part of the strategic planning process to explore the financial implications of different alternatives that the cooperative is considering. The course explores the different elements of a good financial model and shows how to effectively use this information in cooperative management.

a. Load and Sales Forecasts

b. Revenue Forecasts

c. O&M Forecasts

d. A&G Forecasts

e. Marketing Expense Forecasts

f. Purchase Power Forecasts

g. Capital Forecasts

h. Forecasts of Key Financial Indicators

i. Rate Change Projections

j. Financing Projections

k. Capital Credit Projections

l. Budget Projections

m. Educate board members and employees on financial matters

n. Support loan and other financial applications